Custom Manufacturing Services

From prototype to mass production, No minimum order quantity

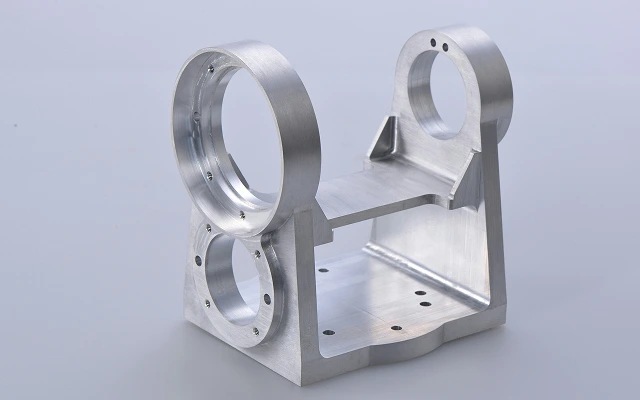

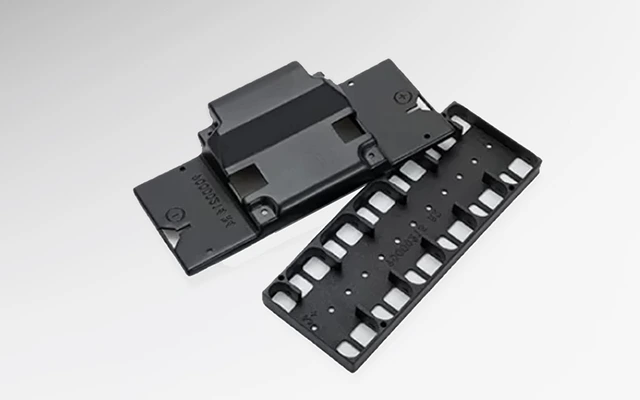

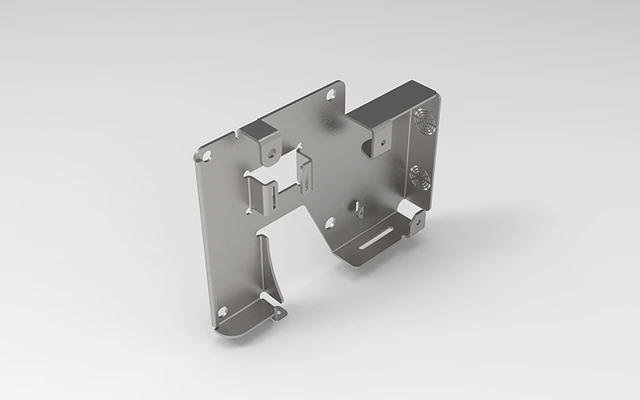

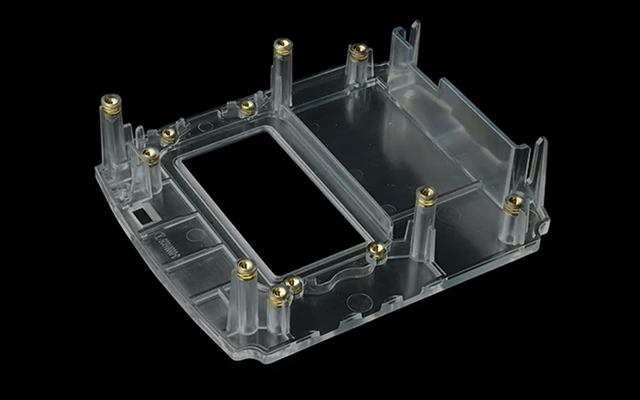

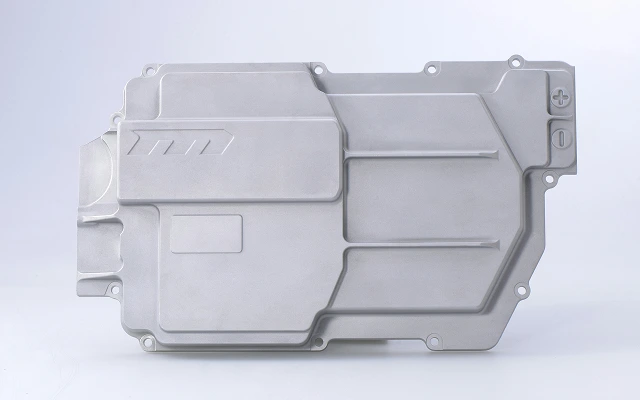

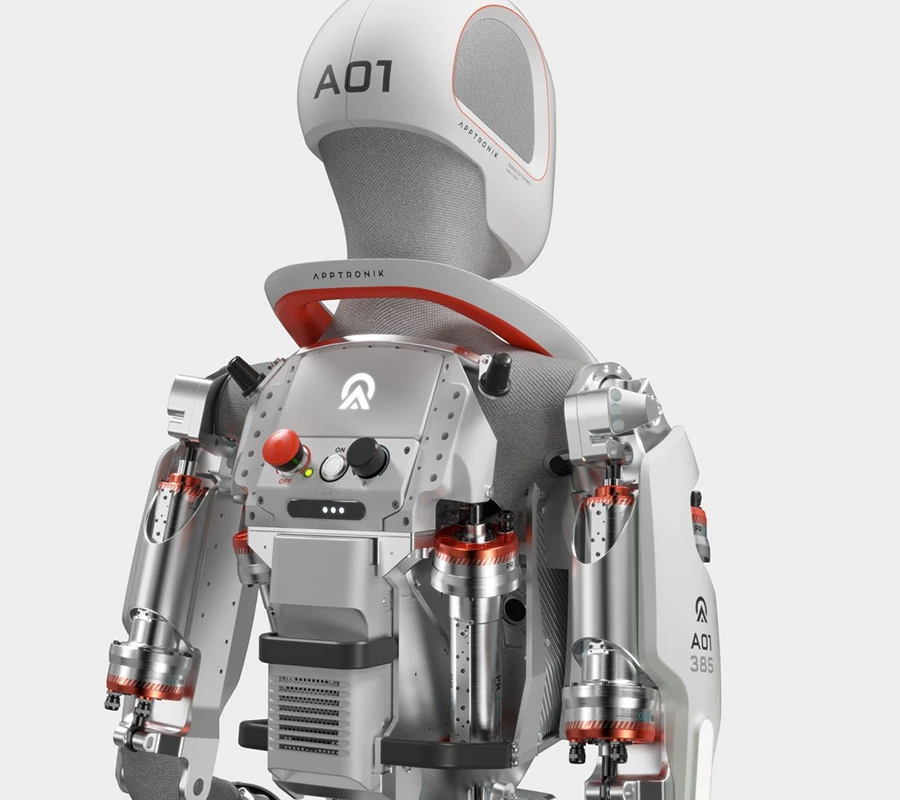

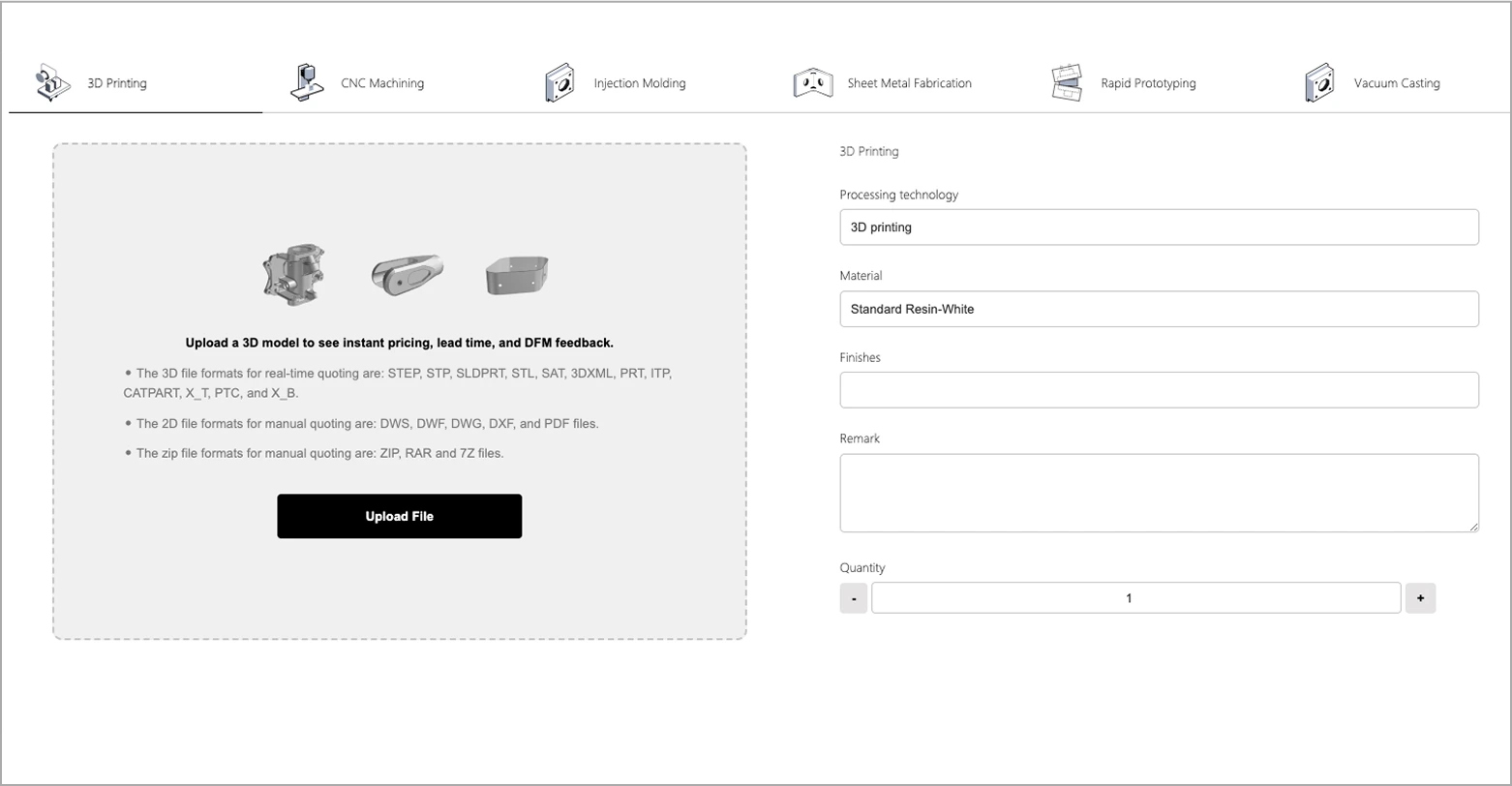

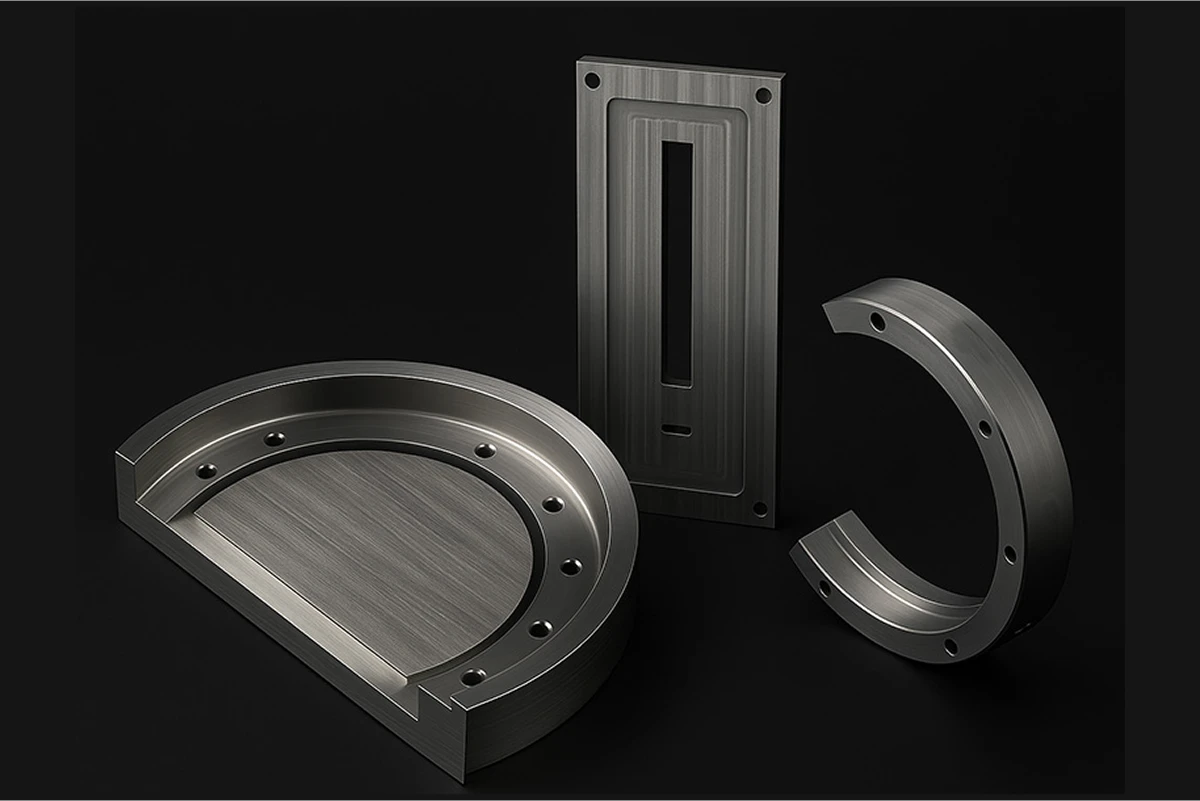

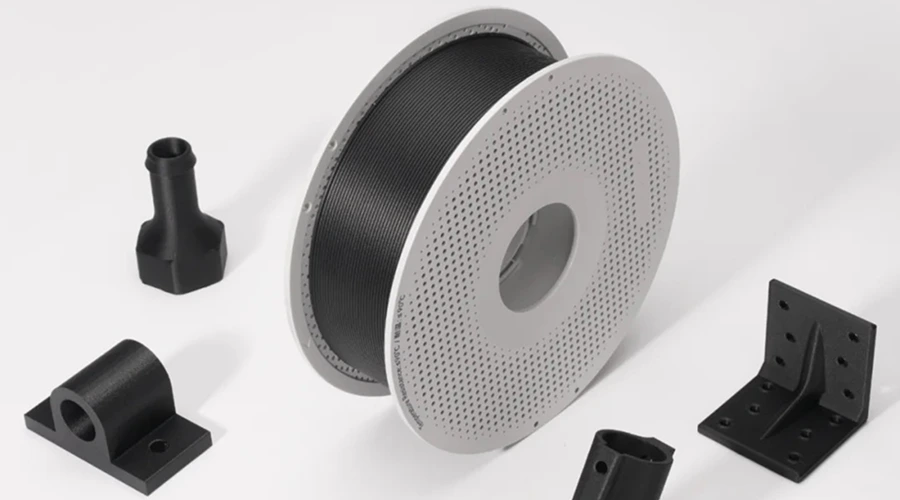

Our first manufacturing plant was established in 2010. We have been providing custom Manufacturing Services to the market for more than 15 years, covering industries such as automotive, aviation, medical, consumer electronics and mechanical industries. Our service range includes 3D printing, CNC machining, injection molding, vacuum casting and sheet metal manufacturing. Whether it is prototype or mass production, we can help you. In 2015, we received investment from FOXCONN and established the global online machining brand XMAKE.